A Token Model for Layer-2 Block Production

Rollups need new token models, and currently-deployed models have shortcomings. In this blog post we propose a new model for layer-2 block production.

About a year ago Fuel Labs launched the first optimistic rollup on mainnet Ethereum: Fuel v1. Fuel v1 supports scalable transfers with simple conditions (including HTLCs, allowing for atomic swaps with Ethereum and Bitcoin). The protocol was able to implement all this while remaining trust-minimized and permissionless, with no admin keys or unilateral upgradability, and was the culmination (at the time) of the original idea of optimistic rollups.

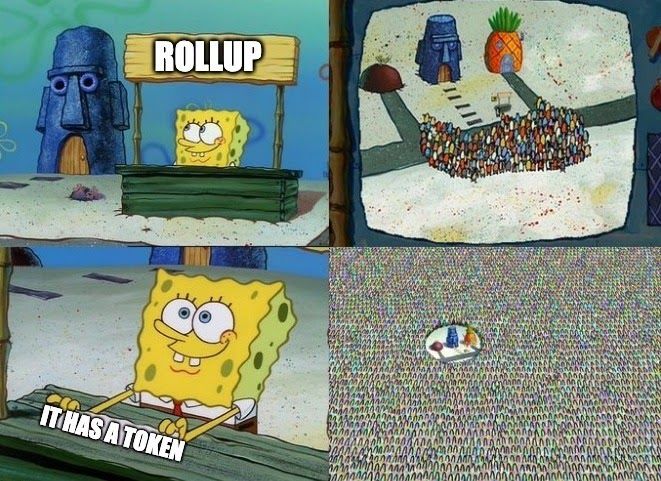

Since that time, we've seen various scaling platforms for Ethereum rise to the challenge of tackling ever-increasing gas prices. And we've seen the role that a token model, or lack thereof, can play in the recruitment of users, developers, and capital to network—and application-layer projects. Now, we’d like to explore some more unique models for layer-2 protocol tokens.

There are many benefits to protocol tokens, e.g. they allow incentivizing liquidity, and can create an engaged community. However, they are not without downsides—and those downsides can potentially make a token worse-than-useless. At the time we took our initial stance against layer-2 tokens, best practices for such tokens were in the early stages and we did not find the case for those early models to be compelling.

Token Models to Avoid

One of the key properties of rollups is trustlessness: the guarantee that users will never have their funds stolen or frozen. This is accomplished through a combination of data availability and fraud proofs (optimistic rollups) or validity proofs (zk rollups). Of note is that rollups are secured by Ethereum, not a separate miner/validator set, and this is a key distinguisher between rollups (layer-2) and normal sidechains (not layer-2).

With that in mind, here are some suboptimal token models that should be avoided:

- A Proof-of-Stake (PoS) token, where a majority of validators sign off on blocks. This allows a majority of validators to censor new blocks, meaning user funds can be frozen. There is no need for PoS to secure a rollup, because a rollup is secured by Ethereum. Note that PoS sidechains are perfectly fine in their own right, it's only for rollups that a PoS consensus protocol is unnecessary.

- A fee-paying token, where users must pay fees in the token. For non-sovereign layer-2 protocols (like rollups on Ethereum), this is worse-than-useless because it adds friction for users to actually use the rollup.

- A governance token, where a majority of votes can upgrade the rollup contract. This allows a majority of token holders to steal all user funds. (More on non-coercive upgrades in a future post!)

Can layer-2s do better?

Exploring Rollup Resource Scarcity

Like any blockchain, transaction throughput within a rollup is constrained by an agreement with its users to support an acceptable cost to run a fully-validating node. This constraint is inherently political: users of a blockchain must agree what constitutes "acceptable" hardware, bandwidth, and validation rate for full validation, given that users who cannot meet these requirements must rely on third parties to access state. Combined with the specifics of the node software's implementation, this constraint sets the upper bound on the number of transactions per second (TPS) that the blockchain can support. An EVM rollup with the same fully-validating node cost as Ethereum would be limited to the same ~15 TPS as Ethereum!

Another way of wording this is that block space (in the form of gas) on the rollup is a limited resource, just like block space on Ethereum. More importantly, block space on the rollup is distinct from block space on Ethereum (see this talk for more). Therefore, scarcity for that space can exist independently of scarcity for Ethereum's block space.

At a more technical level, we can generalize the above exploration to apply to two-layer systems consisting of orthogonally scarce resources:

- a data availability layer (for rollups today this is Ethereum, but in the future could include general-purpose data availability layers like Celestia), and

- an execution layer (the rollup itself).

The finite execution capacity of a rollup is scarce, and this scarcity can be tokenized. Note that this scarcity will exist regardless of whether it is tokenized or not, therefore the addition of a token does not inherently create higher fees.

The simplest example of tokenizing a rollup's scarcity would be to have a fee-paying token, where increasing demand for block space means increasing demand for the token. Unfortunately, as seen in the previous section this adds friction to users. Can rollups tokenize this scarcity without adding friction to users?

It turns out they can! Rollups can tokenize this block space scarcity through the right to collect fees as a block producer. Just as with fee-paying tokens, increasing demand for block space increases fees which increases demand for this right to collect fees. This does not add friction to end users, since they can use the rollup without needing that token to pay fees.

This token model helps solve a major challenge in rollup design: decentralizing block production. While the mechanics are similar to a sidechain PoS token—node operators bond tokens for the right to produce blocks and collect fees—the censorship resistance of the rollup is strictly better: the token is only used for leader selection, so the rollup does not require a majority quorum to vote on blocks.

In Conclusion

- Rollups need new token models, and currently-deployed models have shortcomings.

- The optimum token model for any blockchain is to capture the value of block space.

- The proposed token model allows tokenizing scarce block space without adding the friction of a fee token.

- These tokens have the added benefit of allowing for decentralized block production.

Few.